Important Notice for BPI Direct Account Holders

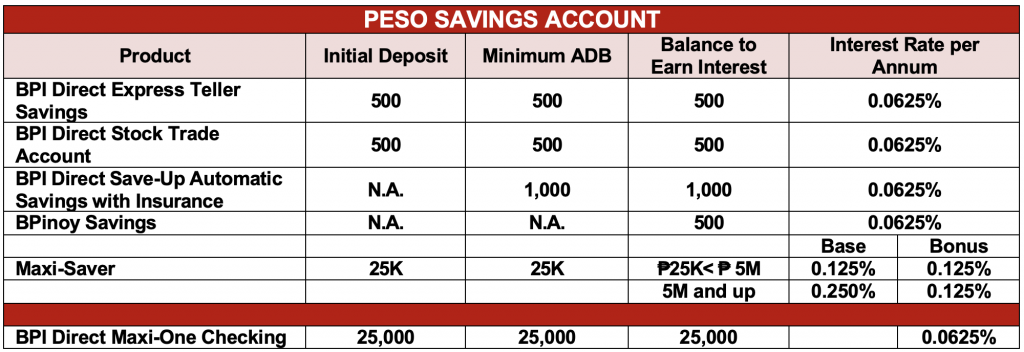

This is a reminder for all BPI Direct (BPID) deposit account holders regarding the current balance requirements, interest rates, and applicable service fees for your accounts.

Member: PDIC. Maximum Deposit Insurance for Each Depositor ₱1,000,000.

Account Maintenance and Transaction Fees

| Particulars | Service Charge |

| Service Charge for Falling below the ADB requirement | P 100.00 |

| Peso Deposit Accounts | USD 5.00 |

| Dollar Deposit Accounts | P 150.00 |

| Monthly Dormancy Charge | |

| Peso Deposit Accounts | P 100.00 |

| Dollar Deposit Accounts | USD 5.00 |

| Save-up Account | P 150.00 |

| Fee for Closing within One Month Date of Opening | |

| Peso Deposit Accounts | P 100.00 |

| Dollar Deposit Accounts | USD 15.00 |

| Balance Inquiry at other Expressnet member banks, Megalink or Bancnet ATMS | P 1.50 |

| Withdrawals at other Expressnet member banks, Megalink or Bancnet ATMs | P 10.00 |

| Balance Inquiry using Cirrus-affiliated ATMs | USD 1.00 |

| Unsuccessful Transaction using Cirrus-affiliated ATMs | USD 0.50 |

| Successful Withdrawal using Cirrus-affiliated ATMs | USD 2.50 |

| ATM Card Replacement | P200.00) |

| Stop Payment Order (SPO) Application per Peso Check | P 100.00 |

| Overdraft (OD) Accrual Charge | |

| Charge | 25.2% p.a on OD amount |

| Subject to a minimum of | P 26.25 |

| PCHC Charges | |

| Temporary Overdraft-Honored (Funded) | |

| Fixed Fee | P 1000.00 |

| Additional Fee | P200 for every P40,000 or a fraction thereof per calendar day |

| Temporary Overdraft-Returned (DAIF/DAUD) | |

| Fixed Fee | P 2000.00 |

| Additional Fee | P200 for every P40,000 or a fraction thereof per calendar day |

| Stop Payment (Funded) | P 2000.00 |

| Stop Payment ( Unfunded) | |

| Fixed Fee | P 2000.00 |

| Additional Fee | P200 for every P40,000 or a fraction thereof per calendar day |

| Technicalities (Returned to Issuer) | P 2000.00 per item |

| Peso Checkbook | |

| Personal (50) pieces | P300.00 |

| Manager’s Check | P75.00 |

| Demand Draft | |

| Fee | ¼ of 1% of amount |

| Subject to a minimum of | USD 5.00 |

| Plus DST, if to be paid in Pesos | Php 0.30 for every Php 200.00 |

| Bank Certification | |

| Peso Deposit Accounts | P300.00 |

| Dollar Deposit Accounts | USD 2.00 |